What is TRICKLE DOWN ECONOMICS?

When I see the term trickle-down economics, I always think trick or treat and in some ways trickle down is trick or treat where we the people have the candy and GOP Congress is at our door saying “trick or treat”. Of course, US Economics is not nearly that simple but, for all the finger pointing and partisan side-taking about trickle or pickle down economics, there seems to be some valid points to the rhetoric be it Conservative or Liberal talking points (oh if Congress could just get along and work together).

When I see the term trickle-down economics, I always think trick or treat and in some ways trickle down is trick or treat where we the people have the candy and GOP Congress is at our door saying “trick or treat”. Of course, US Economics is not nearly that simple but, for all the finger pointing and partisan side-taking about trickle or pickle down economics, there seems to be some valid points to the rhetoric be it Conservative or Liberal talking points (oh if Congress could just get along and work together).

Before we launch into the specifics, let me just state that I am in complete agreement with the Forbes author who stated “The Numbers Don’t Lie-Why Lowering Taxes For The Rich No Longer Works To Grow The Economy“!

Having stated my position, unequivocally, there are some good points to properly bridled and throttled, trickle down economics.

For instance, did we know that starting in 2009, President Obama used some trickle-down techniques to boost jobs and restart the failed economy. He offered incentives to entice the hiring of millions of at that point long-term unemployed Americans. I prefer to call Obama’s approach “Bridled Trickle Down Economics“.

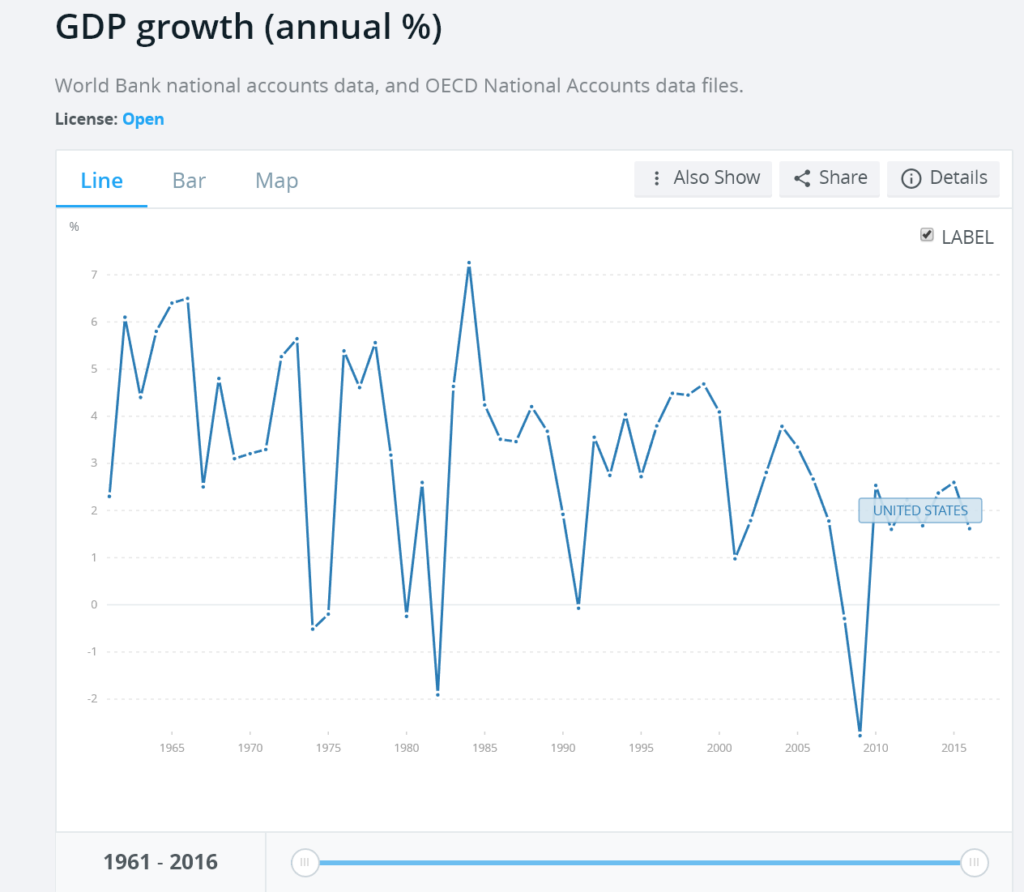

G.W. Bush also used trickle-down economics but in what I term an unbridled or “tax giveaway” format. The G.W. method and strategy failed – miserably! But wait, the Bush/GOP Congress plan looked very similar to what President Ronald Reagan did in the 1980s, called Reaganomics (supply-side tickle or was that trickle-down) and that plan worked out really well, so well in fact, that it is the cornerstone of GOP Economics-101.

G.W. Bush also used trickle-down economics but in what I term an unbridled or “tax giveaway” format. The G.W. method and strategy failed – miserably! But wait, the Bush/GOP Congress plan looked very similar to what President Ronald Reagan did in the 1980s, called Reaganomics (supply-side tickle or was that trickle-down) and that plan worked out really well, so well in fact, that it is the cornerstone of GOP Economics-101.

If that is so, why did Reagan’s approach work (so well) while G.W. Bush use was a “total disaster” (to pun Trump)? What did Obama do to get his trickle to be a treat for the economy – but G.W. a giant trick?

And finally, what of the current Trump/GOP Congress plan – a treat or a trick?

The current potus Trump and his GOP controlled Congress (US House and US Senate Republicans), are dangling a tax overhaul package before We the People today(November 2017). The new GOP tax plan is almost identical to what G.W. Bush did in 2001. It relies on a tax-giveaway approach, giving to the wealthy in the form of tax reductions, incentives. The plan is also cutting middle and especially lower class supplements (including healthcare), to reduce a GOP extravaganza of hypocrisy. Their tax overhaul plan includes raising the National debt by $1.5-Trillion dollars.

Is this tribal partisan GOP tax bill (legislation) a treat, or a trick?

To answer that question will require a bit of background and a couple of additional definitions. In 2008 our economy melted down! The DOW plummeted, some big banks failed and many others were on the brink of failure. Unemployment skyrocketed, the US real estate market lost 50% of value, retail was plundering, the U.S. auto industry was in a state of actual failure; in other words, the US economy was in a state of SEVERE-CONTRACTION! The year 2008 was also a Presidential election year. Prior to the economic meltdown, our two candidates (one Barrack Obama and John McCain, both current Us Senators at the time), had mostly been focusing on ending the war in Iraq, healthcare, and immigration. However, with the Great Recession of 2008, came a new and critical election issue, “stop the bleeding”! Shortly before the November election, our combined Congress reluctantly decided to pass a $700-Billion dollar bail-out bill and was then signed into law by President G.W. Bush. The purpose of the 2008 bail-out was aimed at saving our banking industry from total collapse! A month or so later came the November election and Obama was elected President. TARP as it was called, would be Obama’s first tool in restoring the economy but hardly the last needed.

Obama took office in January 2009 and began the effort of stopping the economic contraction. His critical needs were to saving the banking industry and bringing unemployment down (you know a popular GOP saying “jobs, Jobs, JOBS). The GOP still say this today even though at the end of Obama’s two terms as President, the unemployment rate was at an all time low. Still it is even lower by a tic, today, under Trump. During his first term, Obama also kept valuable industries like our auto manufacturers, afloat, and started many programs to rebuild the shattered economy. We did not see any affect of Obama and DEM Congress tactics (yes the DEMs gained solid control of both Houses of Congress in 2008 as well), until some nine-months after OB and the new Congress took office. October 2009 is when the first rays of hope for restoration began to show light and life in our economic and jobs output.

Ultimately President Obama led 75-straight months of job growth and a restoration of a sound (though not a BOOMING) economy; not perfect but a solid work in progress.

That progress and (Obama’s) legacy continues today but what were the tools that Obama and DEM Congress of 2009-10 used to restore the economy? How does the Obama economic strategy compare with that of G.W. Bush, Reagan, Clinton, Carter, H.W. Bush, and certainly with the Trump/GOP Congress plan before us today today?

First, Obama used a combination of many tools, including trickle-down stimulus, programs to keep the unemployed afloat, direct infusion into failing business, and incentive programs aimed directly at the middle and lower classes to support them and at same time restart the economy. This appears to be the most stark difference between Bush and Obama. Bush used trickle-down strategy, Obama used a suite of other tools including some trickle to bolster and rebuild the economy.

So what exactly was the trickle-down used by Obama vs how GOP Presidents and legislators used/use supply-side trickle-down economics. After all, that is one key to understanding why OB succeeded while G.W. Bush failed, both using trickle-down tactics. What is the difference? We start with some definitions.

Supply-Side Trickle Down Economics is when our Federal government reduces taxes, eliminates tax-related policy or legislation, and/or provides incentives, to the wealthy and to big businesses. Why would our government do that? So that the wealthy will invest their new-gotten gains, tax savings, and tax or outright incentives – to create jobs, expand business, to invest in a better and more productive economy. That’s it! That is the expectation of government for tickle-down strategy. So why then, when Reagan, Obama, JFK, used trickle, did it work (for those administrations), for our economy? Conversely, why, when G.W. Bush seemingly did the exact same thing, did the tactic fail, miserably?

Supply-Side Trickle Down Economics is when our Federal government reduces taxes, eliminates tax-related policy or legislation, and/or provides incentives, to the wealthy and to big businesses. Why would our government do that? So that the wealthy will invest their new-gotten gains, tax savings, and tax or outright incentives – to create jobs, expand business, to invest in a better and more productive economy. That’s it! That is the expectation of government for tickle-down strategy. So why then, when Reagan, Obama, JFK, used trickle, did it work (for those administrations), for our economy? Conversely, why, when G.W. Bush seemingly did the exact same thing, did the tactic fail, miserably?

The answer to this mystery is not simple but I think we can start by providing a summary in two parts. 1. economic performance is dependent on many factors, not just taxes. There is government borrowing (*the deficit*), Federal Reserve policy and actions, including the current Fed Interest rate, major unforeseen events, business trends and decisions, etc., etc. 2. trickle-down can be viewed broken into two methods that tend to have very different outcomes. In fact, for the Reagan version of trickle to have worked,f required a bit of good fortune, good faith by big business and wealth, and basically, trusting the rich to do the right thing. This happened for Reagan but not for G.W. Bush, the rich let him down. Or, did G.W. let us down as well as all who give away without requirement?

The two methods I refer to are Bridled and Unbridled trickle-down economics.

Bridled Trickle Down Economics. This policy is one of providing tax cuts and incentives to business and to wealth, but with stated requirements for getting the savings or incentives. Obama used this form of trickle almost exclusively, when he trickled. This performance-required relationship of taxes and investing in the economy, had a much higher guarantee that the funds allocated to the rich would be used to actually spur the economy, not stuffed away into some wealthy person’s savings plan or portfolio never to see the light of economic growth. Some recent examples of bridled trickle-down economic strategy have been:

- additional tax break to companies that hire anyone unemployed for over a year

- additional tax breaks if business hires employees instead of giving more to shareholders

- Federal grants for specific industry desired startup

Unbridled Trickle Down Economics. This policy is sometimes termed a “big tax-giveaway to the top .001”. Unbridled trickle provides tax cuts and incentives to wealth and to business – with no strings attached! In other words the government gives the money to wealth with no requirements about what to do with the savings and incentives. The government is therefore, hoping, that those rich and powerful will “do the right thing”. They did with Reagan but wealth flipped G.W. Bush the big HAHA (trick)!

Therefore is the “trick or treat” tactic where we give the candy but can only hope that wealth will not trick and keep the money unto self. This is the plan that G.W. Bush passed in 2001, it is the plan Trump and GOP Congress are dangling before us today in November 2017.

Another term for this type of open ended handout was called “Vodoo Economics”, a term coined by H.W. Bush (VP at the time), during the Reagan years. We the People were also fond of calling President Reagan’s approach “Reaganomics”, but trickle-down tactics with no requirement to perform, is really TRICK or TREAT (scary eh?). So why did President G.W. Bush use unbridled trickle-down economics? Why? Well because Reaganomics had worked so well for Reagan that this form of economic plan had more or less become the bible of GOP econ; still is today.

What were the tenets of the GW Bush strategy often dubbed the “Bush Era Tax Cuts”?

“In 2001, President George Bush authorized a tax cut called the Economic Growth and Tax Relief Reconciliation Act of 2001. EGTRRA stimulated the economy during the 2001 recession. It saved taxpayers but increased the debt by $1.35 trillion over a 10-year period.” — the balance —

These (Bush Era), tax cuts didn’t just help those with high incomes, it rained money on their heads in the form of $1.35-Trillion dollars in tax cut savings — and how did G.W. do that? He convinced his own GOP controlled Congress of 2001, to increase the National Deficit (debt) by $1.35-Trillion over 10-years! (sounds familiar eh?) Bush borrowed his way to a Leprechaun’s gold tax-windfall for the rich!

This sounds an awful lot like Trump and the GOP Congress “greatest ever” tax cuts plan in November 2017 and it is, very similar.

Who was first to utilize Supply-Side Trickle-Down economics? President Ronald Reagan of course. We generally called it Reaganomics, sometimes “Vodoo Economics” (see below), but a rose by any other name is still … unbridled, trickle down, tax giveaway, to the wealthy.

Who was first to utilize Supply-Side Trickle-Down economics? President Ronald Reagan of course. We generally called it Reaganomics, sometimes “Vodoo Economics” (see below), but a rose by any other name is still … unbridled, trickle down, tax giveaway, to the wealthy.

In fact, trickle down should sound familiar because it’s the same old plan every time the GOP is in charge. Supply-Side Trickle-Down is the heading in the GOP bible of economics. These are tenets of past and of the current GOP tax plan (the tax brackets are similar but fewer this time around):

- reduced the gift tax

- provided relief from the alternate minimum tax

- phased out estate taxes to be eliminated in 2010

- reduced tax rates: highest 39.6 to 35%; 36 to 33%; 31 to 28%; 28 to 25%

(these are the highest income earner brackets!! – over 200K/yr)

The GOP always throw some breadcrumbs to the rest of us (99.999%) and then their rhetoric makes it sound like we the rest are getting almost all and the poor rich are suffering – but we the rest of us never but breadcrumbs, if that. The GOP never do it any other way. The GOP tax plan-101 is —

give to the rich, take from the poor! So it is in November 2017.

In 2001 – “many people saved their rebates instead of spending them. That’s because those in the high-income tax brackets already had enough disposable income to cover their consumer spending. They used the extra tax savings to boost their investments.” — the balance —

OOPS! The trickle didn’t trickle down in 2001? Why then would our 2017 rich, famous, powerful, and wealthy trickle down the savings this time around? They didn’t trickle it down in 2001. Do the wealthy not have enough money now to pay their expenses or perhaps wealth has grown a conscience? The answer is they won’t trickle the tax windfall (again).

“While supply side economics may have been responsible for some very healthy economic growth, it came at the price of a substantially increased federal deficit. What many forget is that it was during the Reagan years that we went from being a creditor nation to a debtor nation as President Reagan was required to borrow heavily in order to make up for the income shortfall that resulted from so massive a tax cut.”

Why Lowering Taxes for the Rich No Longer Works! – Forbes.com

Rather, the wealthy through their elected, the GOP, tricked and are trying again to trick We the People with a new, 2017, $1.5-Trillion dollar deficit increase – courtesy of the friendly GOP. That is what we the rest of us get if the 2017 tax bill passes.

Here are other facts of history as regards the Bush tax cuts and how very hard it was even in 2010 and 2012, amidst the meltdown, to pry those cuts away from the rich.

“Both Bush tax cuts should have been reversed by 2005. The economy had recovered enough. GDP growth was 3.8 percent in 2004 and 3.3 percent in 2005. That’s faster than the healthy growth rate of 2 percent to 3 percent. If the tax cuts had been reversed, the higher taxes would have slowed spending. That (reversal) might have helped prevent the housing boom that ultimately led to the financial crisis of 2008.”

“In the fall midterm elections of 2010, Republicans gained the majority in the House of Representatives. They wanted to extend the G.W. Bush tax cuts for two more years. Democrats agreed except they didn’t want to prolong the tax breaks to those earning $200,000 ($250,000 for families) or more.”

“The Obama tax cuts of 2010 extended most of the Bush tax cuts; although, it reinstated the estate tax, at a lower rate. Obama also extended unemployment benefits and cut payroll taxes. In 2012, the cuts were made permanent as part of the deal to avoid the (GOP threatened) fiscal cliff.” — the balance —

And we wonder why it is that GOP Congress insists on doing this (AGAIN). The Kochs and the Mercers, and the rest of the wealthy deep state behind GOP Congress are yelling to their Congress “feed me“!

And we wonder why it is that GOP Congress insists on doing this (AGAIN). The Kochs and the Mercers, and the rest of the wealthy deep state behind GOP Congress are yelling to their Congress “feed me“!

This time GOP Congress wants to make the wealthy tax cuts permanent (never expire), while leaving the rest of us on some form of temp fix until the day the Kochs tell their Congress and their President to insist that the rest of us pay our – national deficit! TRICK OR TREAT!!

———- ———- —– TERMS —– ———- ———-

Vodoo Economics (sounds like a line out of Ferris Bueller eh – it is)

Reaganomics (based on the principles of supply-side economics)

Does trickle-down affect the economy or not?

— References —

- Was it 14.1-million, 10-million, or 4.5-million jobs that Obama Created

- Obama Economic Performance

- Obama economic Performance

- What was Obama ARRA stimulus package; Aug-30-2017

- Six Biggest Bailouts in US History – first in 1792!!

- GDP by State as of 2016

- GDP by Metro Area to 2016

- Trickle Down Economics – four reasons it does not add up (scenarios with graphs)

- Why Lowering Taxes No Longer Works! – Forbes.com

The Bush Era Tax Cuts: